2020 Warehouse/DC Operations Survey: COVID-19 pandemic hits, operations respond

The pace of change wrought by e-commerce on warehousing/DC operations has been increasing for several years, but now the pandemic has kicked it into overdrive.

By Roberto Michel· November 11, 2020

Just when it seemed that the pace of change for warehouses and distribution centers (DCs) couldn’t get any faster than it has been over the past few years, COVID-19 came along to show us just how fast that pace of change can be.

Not only does our annual “Warehouse and DC Operations Center Survey” show that the pandemic has made a significant impact on operations when it comes to worker safety and e-commerce responsibilities, but it also indicates that, despite some struggles, most companies are making adjustments.

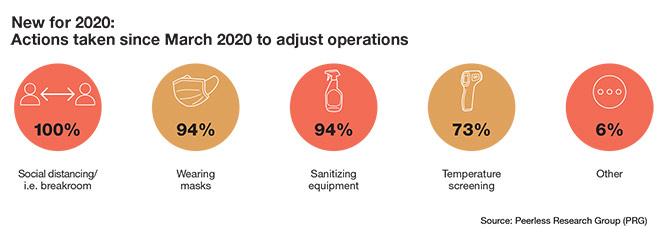

The annual survey always asks about key operational factors, such as facility size, number of employees, and capital expenditure levels; but this year, we added questions geared around the effects of COVID-19, including e-commerce growth since March and practices such as social distancing, mask use, and sanitizing equipment. Overwhelmingly, respondents are taking action via steps like social distancing in areas like break rooms and use of protective masks.

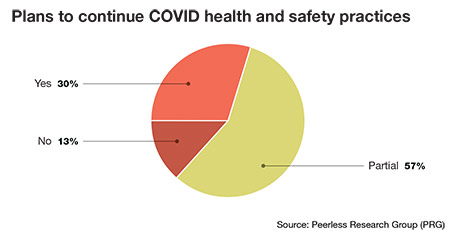

What’s more, 87% plan to continue at least some of these health-related practices after the pandemic subsides, and most respondents also report that, since March 2020, they’ve taken actions to improve warehouse processes and inventory management.

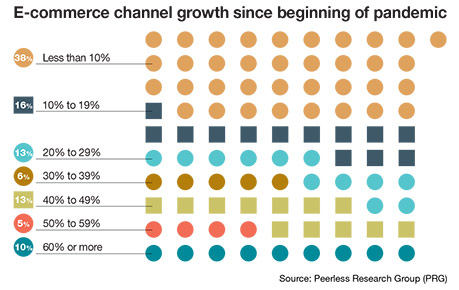

While COVID-19 has caused pain and disruption in many ways, for more than a few DCs, it has meant an increase in e-commerce fulfillment activity. When we asked about e-commerce growth since the pandemic began, 10% of respondents say it has grown their e-commerce channel by 60% or more, and a combined 34% say e-commerce has grown by 30% or greater since the beginning of the pandemic.

The survey, conducted annually by Peerless Research Group (PRG) on behalf of Logistics Management and sister publication Modern Materials Handling, drew 122 responses this year from professionals in logistics and warehouse operations across multiple verticals.According to Norm Saenz, Jr., a managing director with St. Onge Company, and Don Derewecki, a senior consultant with St. Onge Company, a supply chain engineering consulting company and our partner for the annual survey, DC operational change driven largely by e-commerce has been ongoing for several years, but the pandemic has put that pace of change into overdrive.

“This year’s findings are in many ways a continuation of the trends we’ve been seeing for years, but some of these outliers are what I’d call a ‘pandemic effect’ on DC operations,” says Derewecki. “These not only include steps taken for social distancing, but also changes with the size and number of facilities in the DC network, or in having to lease more space, to better service customers.”

According to Saenz, the impact of e-commerce has grown over the years, but now the pandemic has fast-forwarded the trends expected within the next few years down to a few months. “Findings including growth in SKU counts, greater use of radio-frequency-based picking, more evaluation of automation, as well as the increased emphasis on inventory management, can all be seen as evidence of the rapid growth of e-commerce activity that we’ve seen during the pandemic as well as how that’s driving operational change,” he says.

Operations snapshot

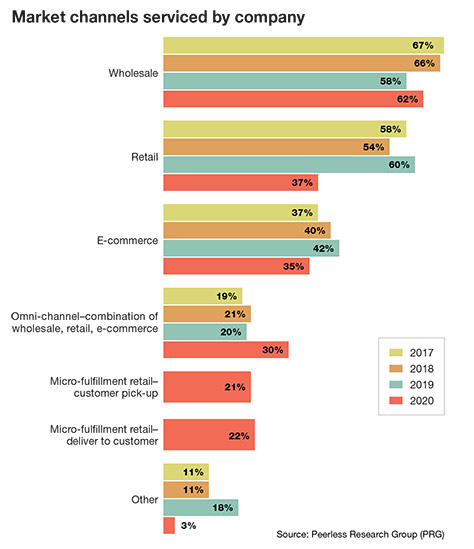

In terms of channels serviced, wholesale remains the most common channel, addressed by 62% (up from 58% last year). However, retail dropped from a 60% response last year to 37% this year, while 30% now say that they have an omni-channel operation, up from 20% in 2019.

The percentage saying that they service e-commerce was down slightly compared to last year, but in new questions this year about micro-fulfillment—the trend of small fulfillment sites within stores or other locations very close to customer concentrations—21% are now engaged in micro-fulfillment customer pickup, and 22% are involved with micro-fulfillment-based deliveries.

Given the COVID-19 situation over the course of this year, we asked about e-commerce channel growth since the pandemic began. While 38% say it caused less than 10% e-commerce growth for them, 10% say it had triggered a surge of greater than 60%, and a combined 28% say it caused e-commerce growth of 40% or more.

The nature of respondents’ inbound and outbound operations is changing in ways consistent with e-commerce growth. In particular, on the outbound side, split-case only reached 8%, up from 3% last year, while a combined 70% have outbound split-case only, case and split-case, or full pallet, case and split-case. On the inbound side, full pallet only dropped by 5% to 14% this year.

When asked how multiple channels are being fulfilled, 36% say they self-distribute from separate DCs for different channels, up from 20% last year. There was an 8% drop in respondents saying that they use a 3PL partner for all channels, while 11% say they only service one channel, down 2% from 2019.

In terms of total square feet in the overall DC network, the average square footage reached 609,325 square feet for 2020, up from 545,860 square feet last year. The most common square footage for each DC also moved up, from 183,750 square feet last year to 191,670 for 2020. For networks with four or more buildings, average square footage reached 452,940—considerably larger than the 285,000 square feet last year.

The number of buildings in the DC network was on the upswing for 2020 as well, with 46% having more than three buildings, compared to 36% in 2019. Additionally, of respondents with three or more buildings, 30% have six-plus buildings, up from 26% last year. Buildings also trended upward in common clear height. The average common clear height in 2020 reached 32 feet, one foot higher than last year’s 31 feet, and more in line with 2018’s 32 feet. For 2020, 14% of respondents indicated the most common DC clear height was 40 feet or higher.

Average annual inventory turns for 2020 respondents came in at 8.2 turns, which is the same as in 2019. SKU counts did rise significantly, up to an average of 12,922 SKUs from 10,615 last year, constituting an increase of 21.7%.

Most of the facility profile findings were consistent with the rapid rise of e-commerce, although, in terms of geographic scope, a smaller percentage of respondents were servicing one metro area. However, 2020 findings such as “more buildings” and “taller/greater clear heights” can be seen as companies trying to better service customers by having more DCs, with some DCs with greater size and clear height suitable for automation and dense storage.

Our finding of more SKU counts in DCs also reflects rising e-commerce activity, notes Saenz. However, one troubling trend is that many respondents still lack a firm grip of item master weights and dimensional (dim) data on their SKUs, he adds. More specifically, while 45% have 100% SKU weight and “dims” in the item master record, 55% lack complete weight and dim data.

Lack of this data makes it difficult to do things like properly size storage and pick locations, determine the amount of inventory that fits in a location, as well as enabling the system to recommend the right size shipping carton. “Lack of accurate item master data is going to negatively impact operations just as they start to become more efficient,” says Saenz. “Operations managers need to establish methods to capture item master data and maintain it over time, especially with the rapid rise of e-commerce.”

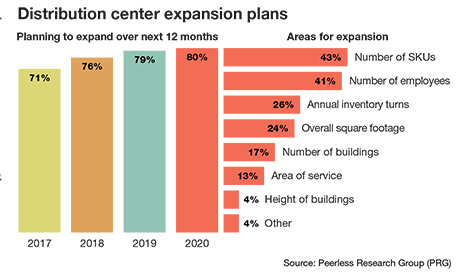

Respondent answers on expansion plans were encouraging, indicating corporate willingness to invest in facilities and resources in the face of accelerated challenges and channel disruption. For 2020, 80% plan some type of expansion, 1% more than last year, and the highest in the last four years for this question. In terms of different areas of expansion, 41% of respondents anticipate the need for more employees, up from 30% last year, while 43% anticipate more SKUs, up from 39% last year.

Perhaps due to many respondents being from smaller-sized companies, the average number of employees in respondents’ main DC contracted from 175 people last year to 125 in 2020. This decline in staffing could be an effect of the pandemic. However, a combined 14% of respondents had more than 200 employees in the main DC and another 11% had 100 to 199 people.

The most congested area of DCs continues to be the shipping dock area, cited by 29% of respondents as the most congested area. For the first time this year, we asked about congestion in e-commerce processing areas and value-added services (VAS) areas, with 8% saying VAS are the most congested areas, and 5% naming e-commerce processing as the most congested.

Some findings suggest a space crunch, with a combined 60% of respondents reporting peak warehouse space utilization of greater than 85%, and a rise in the need to lease additional space during peak season. This year, only 36% report “no need to lease more space” during peak, which is down from 52% last year, while conversely, respondents saying “they did lease more space” are up. COVID adjustments

COVID adjustments

One positive finding is the strong level of action on pandemic related health measures, such as instituting social distancing practices and wearing masks.

In fact, 100% of respondents say social distances practices were in use at DCs in work areas that would normally put people in close proximity, such as break rooms. Additionally, 94% say employees are wearing masks, 94% say they’re sanitizing equipment on a regular basis, and 73% are doing temperature screening of employees.

The annual survey has long asked about actions taken to improve operations, but this year, we added a question about operational adjustments since March to cope with new or accelerated challenges. Most (65%) are improving warehouse processes, while 42% have changed layout configurations or rearranged workstations to support to social distancing.

Many respondents (42%) have increased wages since March to retain and attract staff, 35% have increased staff, 27% have developed different or additional delivery capacities, and 23% have trained staff on new e-commerce fulfillment tasks. Such findings show that for DCs, the COVID-19 challenge isn’t about pondering what the “new normal” may turn out to be, it’s about adjusting for the problematic present, which involves keeping workers safe while fulfilling more e-commerce orders.

To some extent, some steps have been absolutely necessary to prevent infections that could close down a facility. What’s more progressive, Derewecki and Saenz agree, is that 30% of respondents plan to continue new health and safety practices post-pandemic, and 57% plan to continue at least some of the new practices.

“Close to 90% of respondents are going to maintain at least some level of these new practices to improve the level of cleanliness in facilities and help keep workers safe and healthy,” says Saenz. “It’s great to see respondents realizing many of these practices will be helpful long-term in maintaining a stronger, healthier workforce, even post pandemic.”

In their consulting work, Derewecki and Saenz are seeing operations add shifts to lessen the number of workers in a facility at one time to improve health and safety. This is perhaps more common than major changes to facility equipment and layouts.

Another way to keep workers distanced is to adjust the dispatching of work, or to adjust the slotting and zoning of an operation, explains Derewecki and Saenz. Such changes using software and systems not only can help keep workers physically distanced, it can improve efficiencies in tasks like picking.

Our annual survey has always asked about actions taken to lower operating costs. For 2020, the survey found that 98% have taken some form of action to lower costs, which is higher than 2019’s 95%. Among the more specific actions taken to lower costs, 69% are looking to improve inventory control, up from 50% last year.

It’s quite likely that many respondents experienced a big swing in inventory levels related to pandemic consumer buying surges on certain products, and are now looking to rethink what the right stocking levels should be, explains Saenz. “Moving into 2021, being better at inventory control and planning is shaping up as a key concern,” he says. “People are realizing they need to be better at analyzing what they keep on hand and how much of it.”

Systems and technology

Given the considerable challenges facing DCs, it’s fortunate that budgets remain healthy. The average capital expenditure (capex) budget for equipment and technology reached $1.45 million in 2020, up from $1.27 million last year. The median capex figure did decline slightly, but 5% say they have a budget of $10 million or more.

Another sign of continued investment is that 85% use some type of warehouse management system (WMS) software solution. Furthermore, legacy WMS use declined from 35% last year to 24% this year, while use of WMS modules from enterprise system vendor increased, while use of best of breed WMS solutions stayed fairly level.

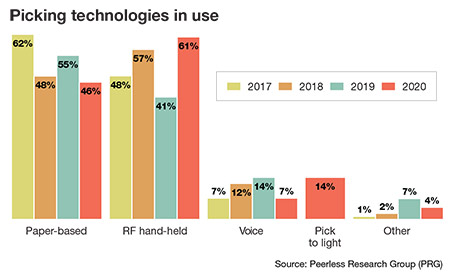

This year’s survey also found a fairly steep drop in paper-based picking methods, with 46% using paper, down from 55% last year, which is the lowest level in the past four years. Conversely, use of RF-based handhelds to help automate picking reached 61%, up from 41% last year, and constituting the highest percentage for RF-based picking in the last four surveys. Reported use of voice picking was down for 2020, but in the first year of asking about pick-to-light as a pick technology, 14% were using light-driven picking.

When asked about data collection methods used to gauge productivity, the survey also found that 63% use data gleaned automatically from a WMS, up by 7% from last year, while manual data collection, used by 58% last year, dropped to 43% this year

Continued technology investment should help DCs leverage metrics to help manage operations. Overall, 98% are using metrics, up from 94% last year. Use of all metric types asked about were on the rise for 2020, with use of on-time shipments up by 10%, for example, and use of order- or line-fill rate metrics jumping up by 18% to reach 61%.

“The increased use of all metrics indicates that top management is pressing operational managers for improved controls and productivity,” says Derewecki.

Tough challenges

When it comes to major issues making an impact on DCs, once again in 2020, the inability to attract and retain a qualified hourly workforce was the top issue, cited by 53% of respondents this year. Difficulty in finding qualified supervisors was also cited by 33% of respondents, just below last year’s 35% who ranked this as a tough issue.

For the first time this year, we asked if challenges tied to a surge in e-commerce constituted a major operational issue, with 37% affirming that it did. This tied with insufficient space at 37% as the second most frequently cited major issue making an impact on current operations. Lack of SKU weight and dim data also climbed slightly, with 24% calling it a major issue.

The survey annually asks whether respondents’ supply chains had experienced a catastrophic event in the last two years—such as hurricanes, other extreme weather events, hackers, strikes, or supplier failures. While 77% say “no,” 23% did say they have experienced such an event.

Again, when it comes to taking actions to lower costs, a net 98% say they have taken some type of action. While improving warehouse information technology and software systems declined, there was a slight (2%) increase in “adding automation equipment to processes.” Given other findings such as greater use of RF-based picking and WMS-generated metrics, it appears respondents see the use of automation as a necessary means of keeping pace with change while holding down costs.

Still deep in flux

Overall, the 2020 survey shows an industry in deep flux driven by the pandemic and the sharp rise of e-commerce fulfillment pressure.

Fortunately, the overwhelming majority of respondents are taking steps to safeguard workers and many plan to maintain some or all of these measures long term while continuing to invest in facilities, automation, and systems to support the operational challenges that stem from the 2020 surge in e-commerce.

“The rapid rate of operational change and requirements brought about by the pandemic is the central focus this year,” concludes Derewecki. “The need to sanitize and keep employees a safe distance apart are priorities most operations weren’t thinking about a year ago, but they are now. Additionally, the acceleration in e-commerce this year is furthering the trend toward higher levels of automation and information systems support, as a means of being able to fulfill orders efficiently and meet the rapid order delivery expectations customers are demanding.”

whole 0 Comments